the Return the week to six days Because its top executives have not yet come to fruition at Samsung. On Tuesday, October 8, the South Korean group apologized, after publishing financial results forecasts lower than investors’ expectations.

No “short term solutions”

“We raised concerns about our technological competitiveness and the future of the company.” He meets Jun Young-hyun, who has just taken over the position of head of the department dedicated to semiconductors. “We who run the company are responsible for all of this.” He adds in his message:

The manager promises to restore Samsung’s technological competitiveness, without choosing to do so “Short term solutions”. He also warns that rethinking the company and organization culture will be necessary. He hopes to plant a “Spirit of challenge” instead of a “The defensive position is to protect what we have.”

Lag in artificial intelligence

In the third quarter, Samsung is expected to report operating profit of 9.1 trillion won (6.2 billion euros). This is much more than last year, when the overproduction crisis was still weighing on the memory chip market. But it is lower than in the previous quarter.

According to analysts, this poor performance can be explained by the difficulties it faces in the semiconductor field. While it remains the world’s leading maker of memory chips, the group is noticeably behind in the field of generative AI. Unlike its major competitor and compatriot SK Hynix, it is not benefiting from the boom in this activity.

Nvidia sources elsewhere

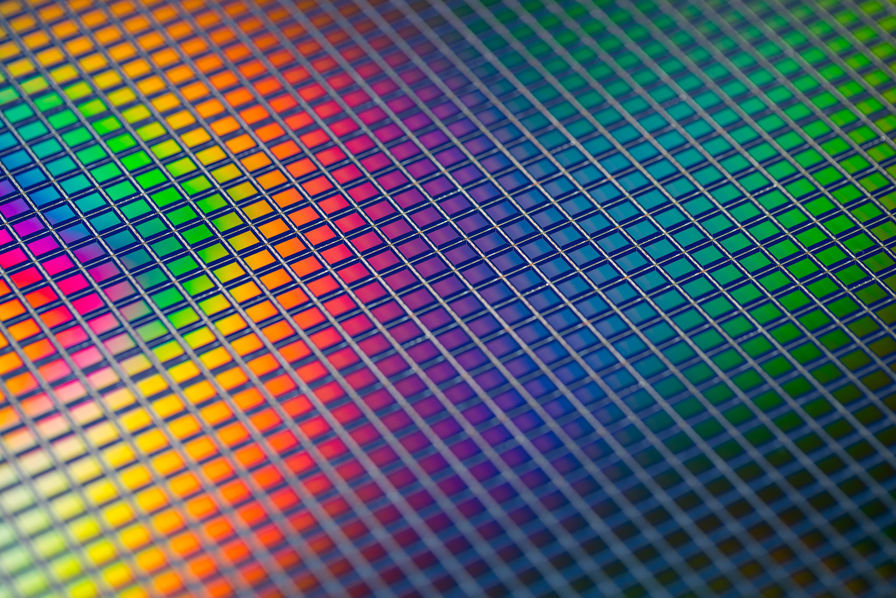

To train the latest AI models, industry professionals use graphics cards (GPU) paired with high-bandwidth memory (HBM) chips, which save space and reduce power consumption. But Samsung is struggling to master the last two generations of this technology. The HBM3 and HBM3e chips reportedly suffer from heat and power consumption issues.

According to the agency ReutersThus, the company missed the certification tests of Nvidia, which captures almost the entire market for graphics processing units dedicated to artificial intelligence. Meanwhile, the American manufacturer is contracting with SK hynix, whose order book is almost full for 2025. The latter should therefore be the main beneficiary of the expected increase in sales.

TSMC digs the hole

Another problem for Samsung: its foundry division. A few years ago, South Korean leaders aimed to close the gap with TSMC, the Taiwanese leader in the sector. Since then, the hole has deepened. According to Trendforce estimates, Samsung’s market share should fall to 10% this year, compared to 16% five years ago.

To fill the technology gap in better engravings, Samsung was relying on a new lithography process, while TSMC preferred to postpone this transition. But it still shows a very low rate of return. So her department is struggling to attract new clients.